The below is a guide on what to consider when constructing your plans.

We suggest that if you are utilising a Direct Debit company (who assist in implementing plans in practice) that you utilise the help they provide.

The first step is to consider what types of health care plans you are looking to implement.

There are no limits to the number of health care plans you can create within Merlin, however more plans require more administration.

An example set up of Health Care Plans is shown below. Note that this is not the only way to setup your plans, as the system is flexible to tailor discount amounts/discount availability. However, this is a common setup that we recommend. (Prices are set for demo purpose only and are not a true reflection on market pricing).

Health Care Plans are specific to a patient’s species. In the above example, we have added the following plans:

Dog Plans

Small Dog Plan (under 10kg)

Medium Dog Plan (10-25kg)

Large Dog Plan (26kg+)

Puppy Plan

Cat Plans

Cat Plan

Kitten Plan

Other Plans

Rabbit Plan

Creating plans this way allows you to have different pricing for animals based on size and age.

A Core Category is a Treatment Group that is used to flag your main Treatment Groups.

If an account was not fully paid when the plan is ended, the core categories treatments value is used to calculate the debt value against the payments taken. Not all categories count towards the plan value, i.e. 10% off food, so this would not be a core category.

We recommend your core categories to be items/services that are the main reason a Client joins their patient onto a Health Care Plan.

For example: Vaccinations, health checks, wormer and flea treatment.

When you end or renew a plan the core categories provide an indicative pricing of what is used. Non-core categories are benefits such as discounted diets.

It is important to consider the availability of your core categories.

We recommend tightening the availability of core items, in order to avoid a scenario of a patient joining a health plan, benefiting from all treatments within the first few months (and failing to pay their direct debit once they have received treatments).

However, it is also important to allow flexibility to avoid the scenario of a Patient coming into the practice for a vaccination and not being eligible for a discount because their appointment is 1 day early/later than the discount period.

As mentioned above, it is important to restrict the availability of your stock to avoid undercharging.

For example, if you are wanting to limit the amount of vaccinations available to health care plan patients, we can set the number of vaccinations allowed (1) within the first 8 weeks of joining the plan (56 days).

We can then add the treatment group again with different attribute. Foor example, the next allowance would be 1 vaccination allowed 8 weeks to 16 weeks after joining the plan.

You will notice that we added the start period as 42 (6 weeks after plan start date, rather than 8 weeks). The reason for this is to allow for a 2-week grace period. For example if the patient has come in for their appointment 2 weeks earlier than anticipated, they would be eligible for the discount.

Note that the view order is set to 1 for the vaccinations available 0 to 56 days and the view order is set to 2 for vaccinations available from day 42 and end 112.

This means that within the crossover period (After 42 days to 56 days), the group with the lowest view order will be discounted first.

Your items may be available at variable discount rates based on the amount of time the patient has been on the Health Care Plan.

For example, you may wish to promote: “Get your first Consultation free followed by 50% off future Consultations”.

To achieve this, you will need to add the treatment group to the Health Care Plan twice to setup the different discount amounts (documented below).

1) Add a Consultations group with 100% discount, set number available to 1 (so that the discount will only apply for their first consultation).

2) Set the View order for this group to 1 (as it is the first discount to be applied). 3) Set the start period to 0 and end period to 365 (as the patient is entitled to the consultation at any time).

The next step is to add the same treatment group to the health care plan, but with different plan attributes.

1) Set the discount percentage to 50%.

2) The Start and End periods remain the same as above, however the number allowed is set to 999 (unlimited) and view order is set to 2.

Setting the 'View order' to 2 means that this discount will only be applied once the above category with view order 1 has been applied.

Non-core items are items/services that are discounted once the patient has joined a Health Care Plan. I.e. pet food, pet shop items, pet passports, nail clipping etc.

Merlin facilitates ongoing discounts and one-off discounts.

Example: ’50% off first purchased bag of food’.

Discount Percentage = 50 %

Number Allowed = 1

Start Period = 0

End Period = 365

Example: ’10% off all pet food’.

Discount Percentage = 10 %

Number Allowed = 999

Start Period = 0

End Period = 365

It is possible to combine the two types of discounts, however please note that only 1 treatment group can be assigned to a code. Therefore, to combine these discounts we recommend utilising the Start and End Period fields.

In the event of a deceased/euthanised patient, the user will need to manually end the Health Care Plan and cancel their direct debit (dependent on the contract agreement).

A List of deceased animals can be extracted from the Reports Wizard (Marketing > Reports > Reports Wizard) using the below criteria:

1) Set ‘Euthanasia’ dates to display patients euthanised/deceased between the dates specified.

2) Tick ‘List Patient details’.

3) Untick ‘Exclude Euthanasia’.

4) Select List'.

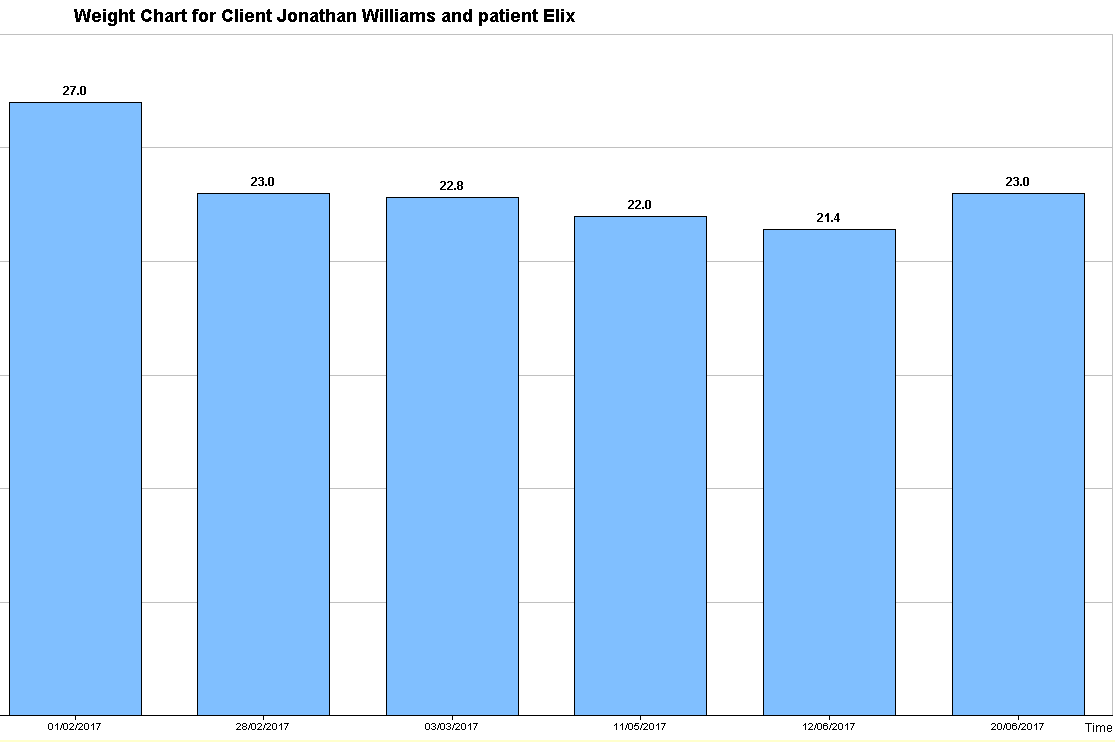

If Health Care Plans are based on a Patient’s weight (i.e. Small dog under 10kg, medium dog 10-25kg, large dog 26-40kg etc), note that a Patient’s weight will change over time.

Therefore, when joining a health care plan, you should consider/estimate the patients weight over the plan length because the plan contents cannot carry over from one plan to another.

The plan itself is a self-contained contract, meaning once a patient has joined a plan, they remain on the plan until the plan length is exhausted.

If managing plans by weight, it is also important to consider the renewal of a health care plan. In the example below, the patient is joined onto the large dog plan (26kg to 40kg). We need to review whether this animal is likely to gain weight and remain on the large dog plan, or if it is worth renewing the animal onto the medium dog plan.

Looking at this example animals weight chart (Treatment > Weight Chart), we can see that he should be on the medium dog plan after his weight loss.

Therefore, I would set the plan to auto-renew onto the medium dog plan rather than renew onto the large plan.

Merlin is currently integrated with EasyDirectDebits who facilitate the collection of Direct Debits. If using this integration, you are able to create subscriptions within Merlin and the direct debit payments will automatically import into Merlin.

If you do not use EasyDirectDebits, direct debits can be manually imported into the system using a CSV template. We recommend collecting direct debits once a month.

We advise looking over the direct debit amounts imported (Administration > Health Care > Reports tab > Direct Debit Import) at the end of each month to ensure values are correct and to take note of any missed payments.

The Renewals tab (Administration > Health Care > Renewals) can be used to facilitate the renewals process.

Reviewing a plan once a year is good practice. Without reviewing your renewals, you could be undercharging clients after a year and much more after 2 or 3 years.

Remember the HCP balance is indicative, if your contract with your customer is for £120 a year and this is all paid, then select ‘write off debt balance’ in renewal.

Copyright © 2013-2021

MWI Animal Health, an AmerisourceBergen Company